I like to think of dividend producing stocks in my portfolio as stable, defensive investments. Just as shock absorbers provide a smoother ride by reducing the impact of bumps and potholes in your car, dividend stocks can help smooth out the overall performance of your portfolio during market fluctuations.

For those who appreciate and are looking for quality dividend producing stocks to generate passive income in 2025 and beyond, Western Union ticked all of my boxes when I recently opened a position. Not only a digital payments giant with stable dividend growth but the stock price today represents deep value for those patient enough to hold the stock for the long haul.

Headquartered in Denver, CO, Western Union (WU) is a renowned name in the global payments industry, offering robust services in money transfer and payment solutions. With rising transaction volumes and resilience in its Branded Digital business, the company is poised for growth. Strong performance in Latin America, Caribbean region and North America are supporting its Consumer Money Transfer segment’s growth.

Western Union's attractive dividend yield, currently at 9.17% compared to the industry average of 0.7%, has been very stable and likely to grow in the future. In 2024 the company rewarded its shareholders with ~$318 million in dividend payments and share buybacks totaling $352 million.

The share price has been depressed over the last 5 years and is currently sitting at its lowest level ever in its almost 20 years trading on the NYSE, offering what I think is good margin of safety in a global company that could be right shipping its operations. Western Union's performance in recent years has been weak, which I think has played into the idea that the company is being disrupted by newer players. Some of this may be true, But I think the pressures the company has faced historically will ease a bit going forward and the market will start to reconsider how they are pricing WU.

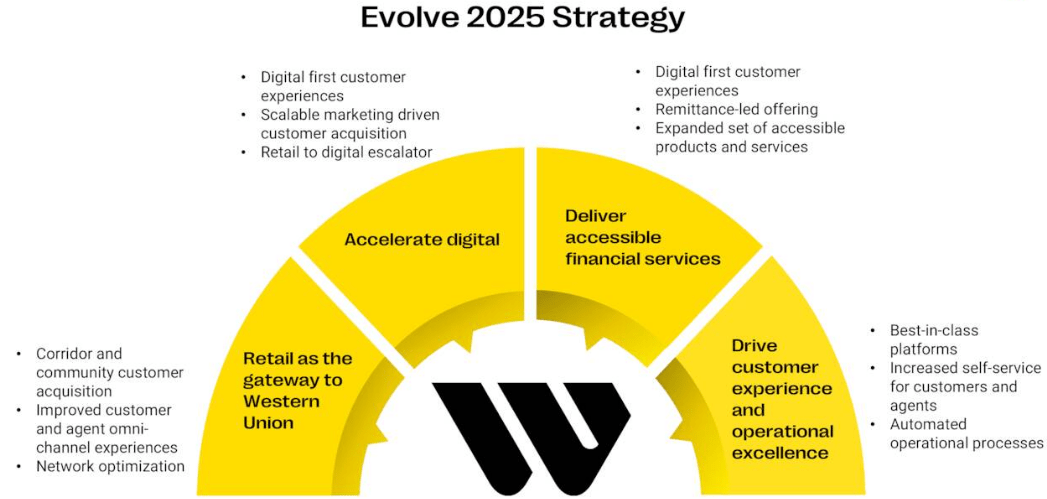

Led by relatively new CEO, Devin McGranahan, who came from Fiserv the company is focusing on growing its digital money transfer service to adapt to changing dynamics through its EVOLVE 2025 strategy.

The decline in its core traditional money transfer business might impact the company in the near term. However, its ongoing digital transition may act as a partial offset. Management expects to expand its Consumer Services segment and targets double-digit growth in this segment. Since the margin profile of this segment is attractive, further growth may positively impact WU’s bottom line in the future.

Collaborations with fintechs and financial institutions are enhancing Western Union's service offerings. Its partnerships with Katapulk Marketplace, Visa and Tencent, should help the company in sustaining transaction volumes. Innovations like Send Now, Pay Later, which integrate lending and remittance, are expected to help the company better penetrate new and existing markets. WU’s extensive global network, spanning more than 200 countries and territories, further strengthens its market position and accessibility.

During 2022, 2023 and 2024, Western Union repurchased common shares worth $400 million, $351.8 million and $352 million, respectively, It also paid out dividends of similar amounts.

A strong financial position equips a company to pursue uninterrupted share buybacks and dividend payments. The same has been the case with Western Union, which is backed by a sound cash balance and adequate cash generation abilities. It had cash reserves of around $1.1 billion as of Sept. 30, 2024. Western Union also reports Q4 2024 Earnings tonight after close which will shed additional light on last year’s performance. Revenue is expected to come in at $1.03B and EPS at 0.42.

Western Union currently trades at a ~5.2 Price to Equity (P/E) ratio. The discrepancy between WU’s P/E compared to its industry peers could be seen as an opportunity. WU’s peers trade at an average P/E ratio of 33. Now, some of this discrepancy can be due to the narrative that competitors are taking market share, but WU still has a large consumer base and has been slowly increasing profitability in its growth segments such as consumer services. In my analysis, the intrinsic value of the company is roughly $19 per share when factoring in fairly conservative growth numbers. Even this base case represents significant upside from where the stock is trading today. However, the question that nobody has the answer to is when will the market start to re-price WU similar to its industry peers.

The power of owning a high-yield dividend stock for long periods of time can be immense. For example, if you were to invest $10,000 in WU at today’s prices, assuming a 1.5-2% expected annual dividend increase and a modest 7% annual share price appreciation (industry average is 10%) you would have $102,000 after 20 years of reinvesting the annual dividend. Western Union is a stable company that may not have Nvidia-level growth opportunities, but it does play a specific role in a portfolio that can offset more aggressive investments, which is why it is my dividend pick for 2025.